Updates:

Agri Loan

Bank offers agriculture loan. For many farmers just starting out, access to credit is a make-or-break issue that will largely determine whether or not they decide to pursue a successful career in agriculture.

Direct and guaranteed farm loans provide a crucial source of capital for beginning farmers and others not well served by commercial credit. Launching the next generation of farmers requires a commitment to providing capital for the purchase of farmland, equipment, and other necessities required to start a successful farm business.

- Land Development

- Agricultural & Allied Activities

- Project Loan

Our Bank provides term loan facility for development of agriculture land for cultivation of cash crops, purchase of new agricultural land for small and marginal agriculturists.

Brahmadeodada Mane Co-op Bank consists of highly experienced professionals who are committed towards understanding your business needs and develop a long term satisfying relationship.

-

Margin applicable as per Banks prescribed norms

-

Maximum Repayment period is 5 years with equated annual installment.

-

Holiday period will be given according to project requirement

-

Future prospects in the related sector & its’ techno-financial viability will be considered.

-

Service Charges and liking share capital contribution will be as per policy of the bank.

-

Prime and Collateral security required as per Banks prescribed norms

Agri Loan Required Documents

Basic documents required for Agri Loan.

- Cibil Report

- 7/12, 6D and 8A Extract required of agricultural land.

- Declaration on non judicial stamp paper of Rs. 100/- regarding annual income and supporting bills and bank account statement where these bills received are credited.

- Valuation Certificate from govt. approved valuator on the panel of the Bank

- 7/12 and 6D extract/Mutation Extract of last 30 years

- Copy of registered sale deed of agricultural land

- Copy of registered agreement to sale in case of purchase of agricultural land by the small and marginal agriculturist

- Project report of development of agricultural land for cultivation.

- Requirement of other documents will be advised as per necessity of proposal.

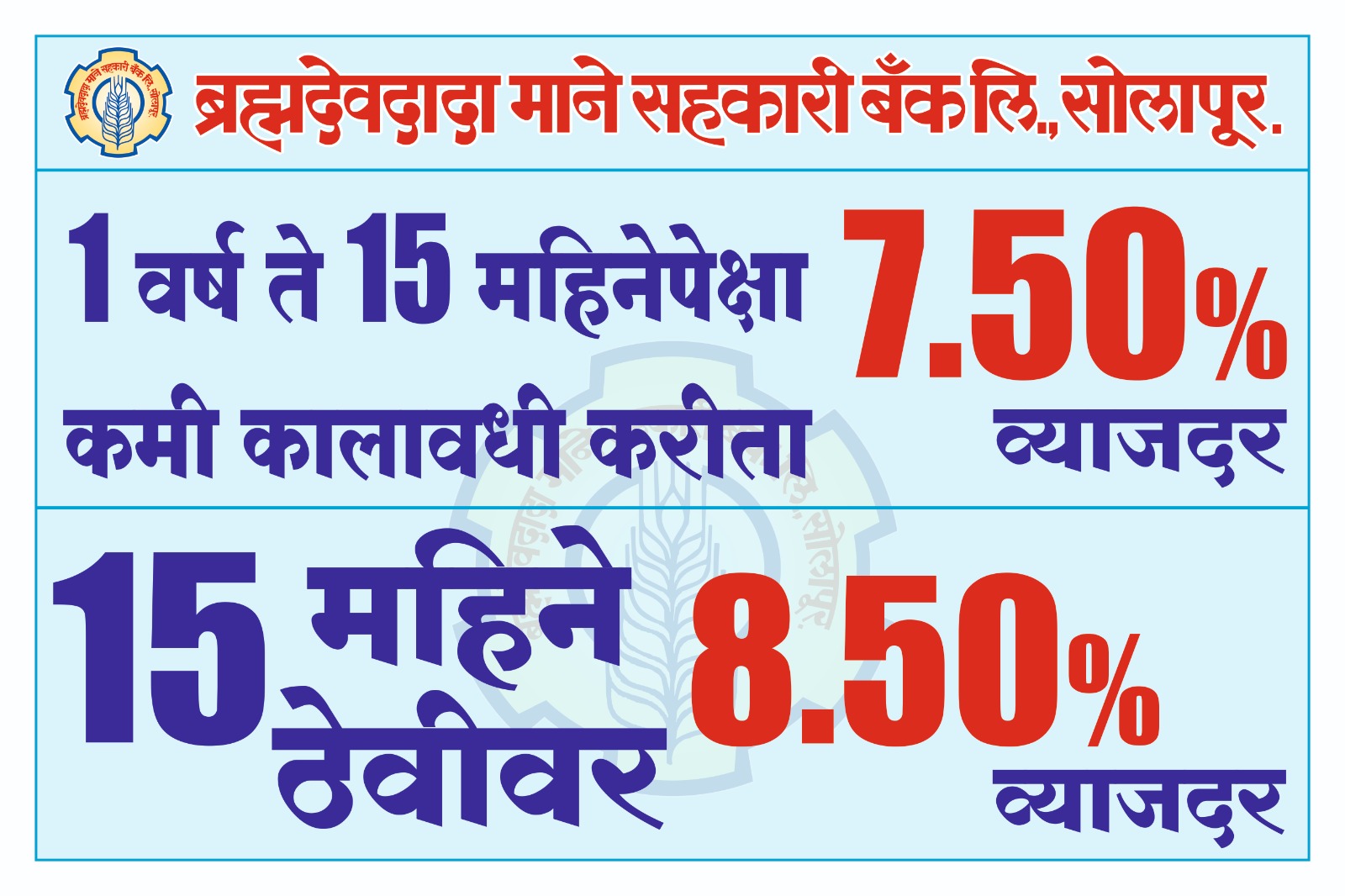

Rate of Interest offered

Account Interest Rates Per Annum

Loan Amount

|

Rate Of Interest

|