Updates:

Get More From Your Money

Know About

Term Deposit

TERM DEPOSIT CERTIFICATE : The Bank will issue a certificate to all types of term deposits (under Non cumulative and Cumulative scheme) in favor of the depositors showing the amount deposited, the period for which the deposit has accepted, maturity date, maturity amount and details of nominated person if registered and if so desired by the depositor

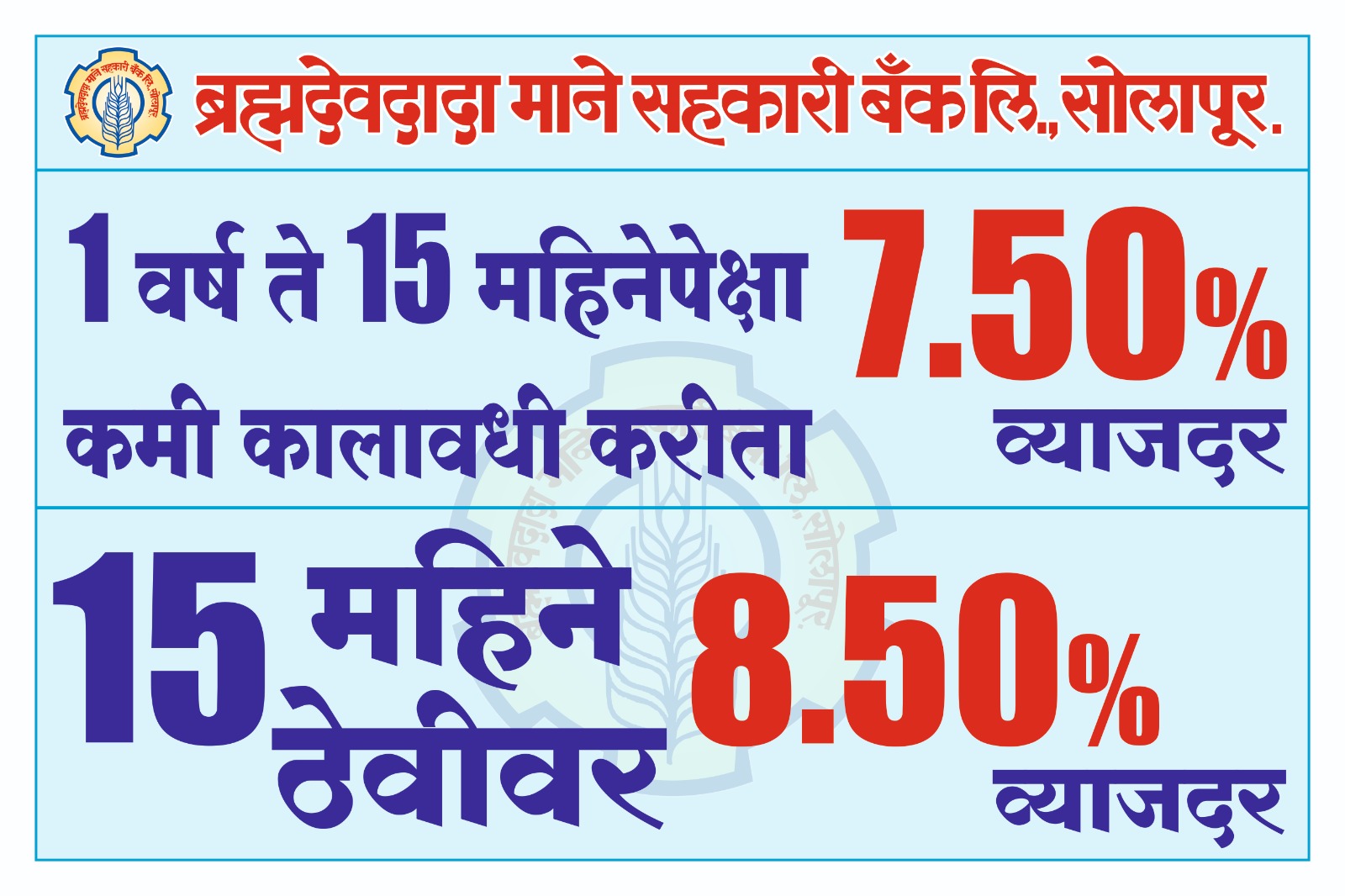

INTEREST : Interest will be paid on the deposits at the rate in force from time to time. Senior Citizen will get 0.50% above the rate of interest offered to normal depositor for all types of schemes of deposit.

DUPLICATE CERTIFICATE : In case of loss of original Fixed Deposit Certificate the depositor would have to intimate the Bank immediately. On an application satisfying the prescribed rules the certificate indicating the particulars of the deposit will be issued to the depositor. The Bank will charge Duplicate Certificate at such rates as in force from time to time.

LOAN AGAINST DEPOSIT : For non cumulative deposit 80% and for cumulative deposit 70% Loan against deposit amount is available at 2% spread. (Provided monthly/quarterly interest of non cumulative deposit will be transferred to loan account instead of saving/current account of the depositor)

NOMINATION FACILITY : Nomination facility is available for all types of term deposit schemes for deposits of individual persons & proprietary firms only.

If nomination facility is not availed by the depositor, in case of death of depositor, survivors / legal heirs of depositor will have to submit Affidavit & Indemnity or Succession Certificate obtained from the court as applicable to conditions mentioned in the policy of the bank. It is applicable to all types of saving accounts with the bank.

BEFORE MATURITY CLOSURE OF DEPOSIT : The rate applicable for before maturity closure of deposit would be 2% less than the rate applicable for the actual tenure for which the deposit was in force with the bank (applicable rate of interest - as on the date on which deposit has kept.)

Term Deposit Schemes

-

MONTHLY INCOME DEPOSIT SCHEME

MINIMUM DEPOSIT : Rs. 1000/-

Tenure of Deposit:- Minimum tenure for deposit is 12 months and maximum is 120 Months.

- Interest will be paid on the deposits at the rate in force from time to time.

- Interest amount will be paid monthly. Interest will either paid in cash or credited to the Saving/current Account of the depositor.

-

QUARTERLY INCOME DEPOSIT SCHEME

MINIMUM DEPOSIT : Rs. 1000/-

Tenure of Deposit:- Minimum tenure for deposit is 12 months and maximum is 120 Months.

- Interest will be paid on the deposits at the rate in force from time to time.

- Interest amount will be paid either quarterly or on maturity.

- Interest will either paid in cash or credited to the Saving/current Account of the depositor.

-

SHORT TERM DEPOSIT SCHEME

MINIMUM DEPOSIT : Rs. 1000/-

Tenure of Deposit:- Minimum tenure for deposit is 30 days and maximum is 364 days.

- Interest will be paid on the deposits at the rate in force from time to time.

- Interest amount will be paid on maturity.

- Interest will either paid in cash or credited to the Saving/current Account of the depositor.

Didn’t get, Click below button to more anwers or contact us.

Experience a New Banking

Banking with new & exciting features.