Updates:

Business Term Loan

Our Bank provides term loan facility for new and existing business for additional activity and expansion of business unit, acquisition of fixed assets like factory shed/ industrial plot, Plant & Machinery, equipments, furniture and fixture etc, up-gradation of existing unit, and to meet short term as well as long term funding requirements.

- Machinery loan

- Business expansion Loan

- Project Loan

Brahmadeodada Mane Co-op Bank consists of highly experienced professionals who are committed towards understanding your business needs and develop a long term satisfying relationship.

-

Margin applicable as per Banks prescribed norms.

-

Maximum Repayment period is 60 months with equated monthly installments.

-

Holiday period will be given according to project requirement.

-

Future prospects in the related sector & its’ techno-financial viability will be considered.

-

Service Charges and liking share capital contribution will be as per policy of the bank.

-

Additional security required as per Bank’s prescribed norms.

Business Term Loan Required Documents

Basic documents required for Business Term Loan.

- Registration/incorporation/commencement of business certificate according to related entity

- Brief history and profile of Company/Firm and it’s promoters.

- CIBIL Report

- Bank Statements for last 12 months of all existing loan/OD accounts

- Audited Financial Statements, copy of ITR and computation of income for last three financial years of the company/firm.

- Net worth of related entity’s directors/partners/proprietor.

- Project report of related project

- Sanction Letter of an existing bank/financial institute limit (if any).

- Any other documents as required by the bank at a later stage

- Requirement of other documents will be advised as per necessity of proposal.

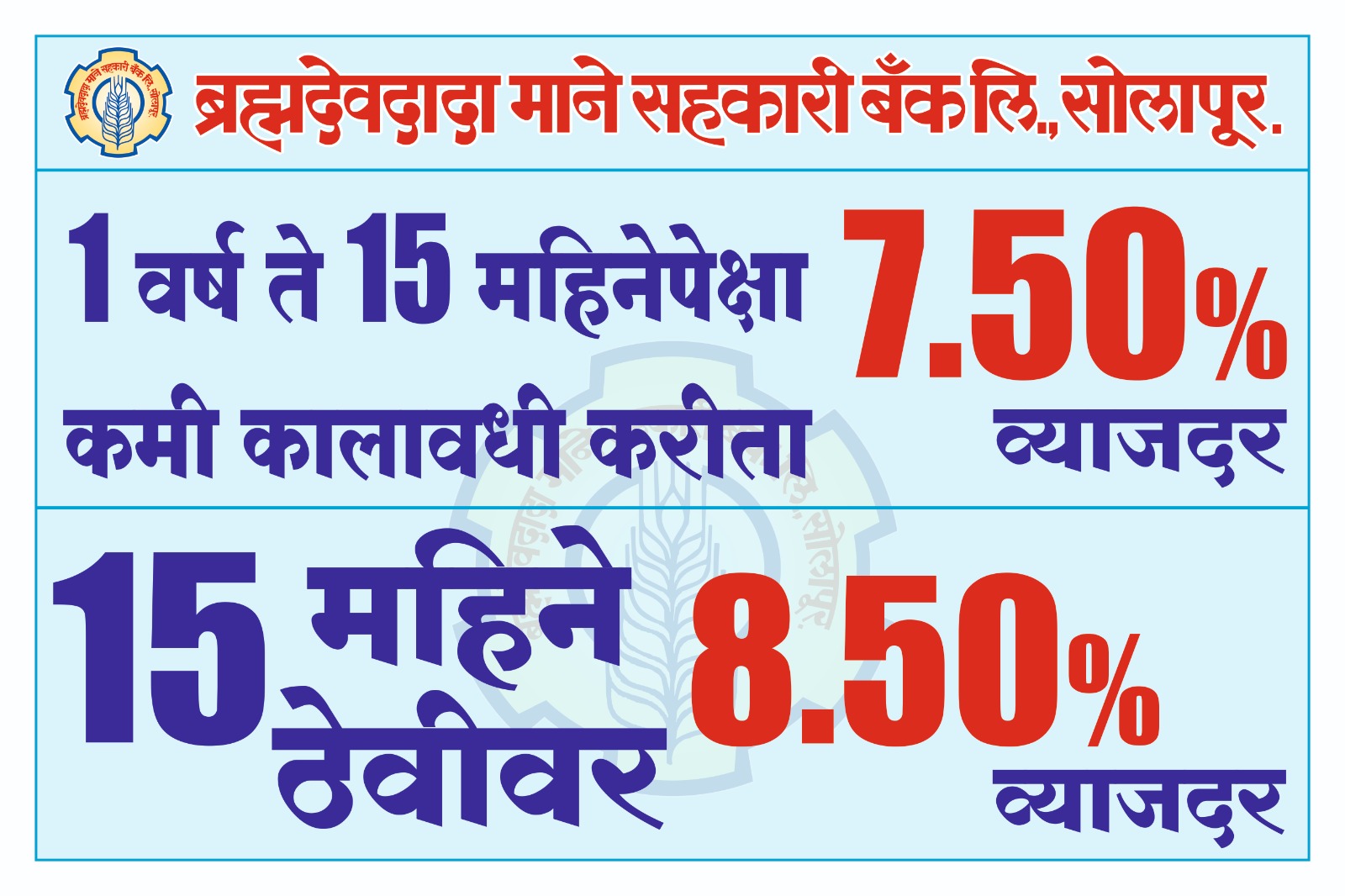

Rate of Interest offered

Account Interest Rates Per Annum

Loan Amount

|

Rate Of Interest

|

Experience a New Banking

Banking with new & exciting features.