Updates:

Home Loan

Buying a home is now easy with BMS Bank Housing Loans. Get Instant Home Loan EMI Quotes and apply for a home loan with BMS Bank at an interest rate starting from 10%* p.a.

BMS Bank offers you home loans that you can avail to buy, construct, or renovate your house. Our easy home loan application process, hassle-free documentation requirements and customised repayment options ensure that you make your dream home a reality. Apply Now with BMS Bank Home Loan to meet your housing finance needs.

-

Maximum Loan Amount Upto INR 140.00 Lakhs

-

New construction of Bungalow, Row house & purchase of Flat/Row house.

-

Any Individual who is Member of our Bank.

-

Limit of loan will be According to Policy of the bank

-

Loan Repayment Period is 5 / 7 Years

-

Mortgage of property to be purchased or any other additional security.

Housing Loan Required Documents

Basic documents required for Housing Loan.

- Income Proof of Applicant and guarantors

- If Applicant is an Employee, Salary Certificate of last three months, Form No. 16/ copy of ITR

- If Applicant is Businessman, Registration certificate of business, Financial statements, Copy of ITR, Computation of income for last three years

- If applicant is Agriculturist, 7/12 and 8A extract of agriculture land, declaration of income on INR 100 non judicial stamp paper and supporting bill and account extract of bank account at which the bill submitted is credited.

- Property documents - Property extract, Final layout of property, Building Permission, Approved Building Plan, Estimate for construction Loan.

- For Purchase of New / Old constructed property Agreement to sale, Completion certificate (if it is old or new constructed property and newly constructed Flat) Property extract, Final layout of property, Building Permission, Approved Building Plan, Estimate for construction Loan.

- Requirement of other documents will be advised as per necessity of proposal.

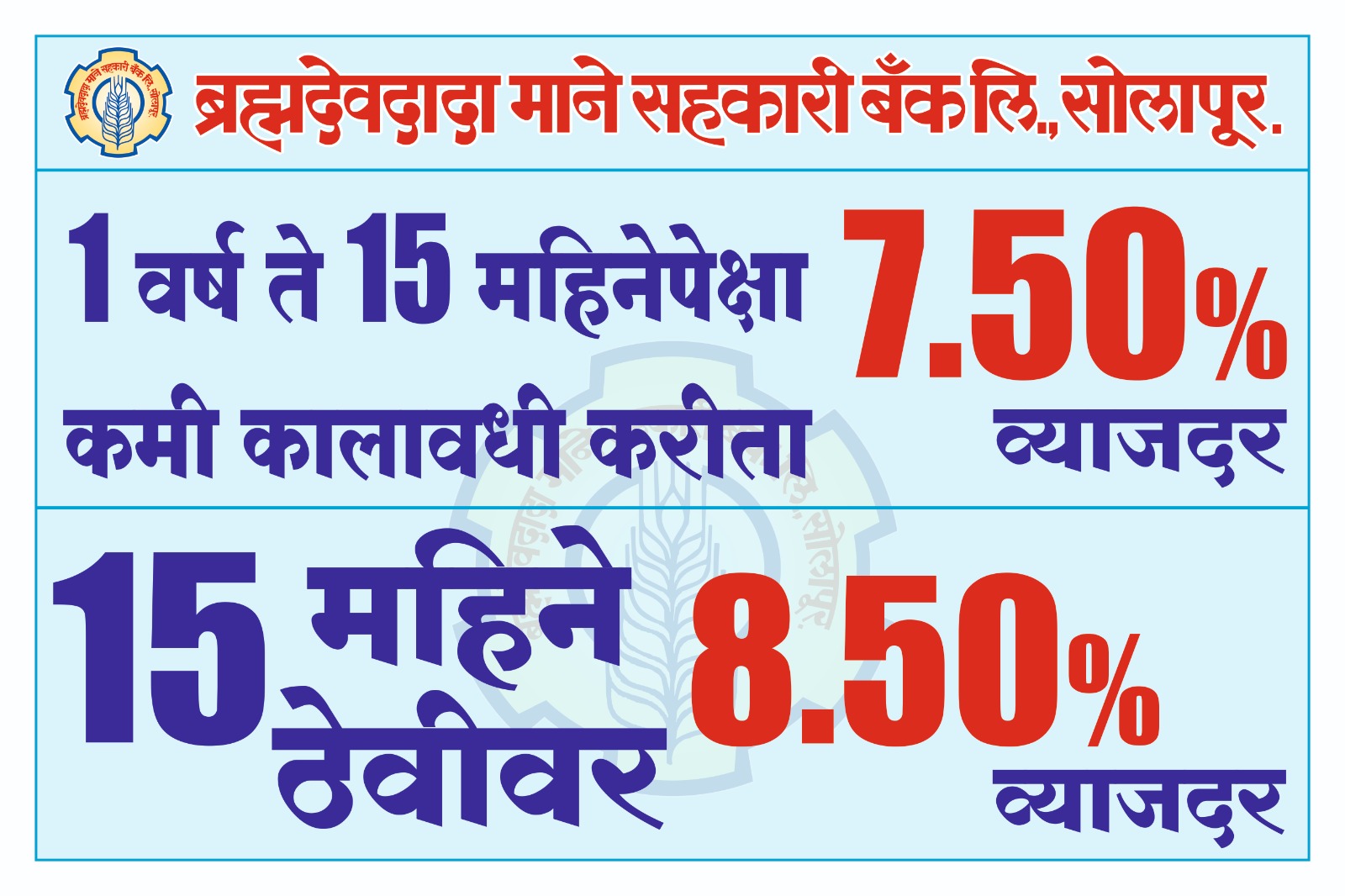

Rate of Interest offered

Account Interest Rates Per Annum

Loan Amount

|

Rate Of Interest

|

Experience a New Banking

Banking with new & exciting features.